Future Value of Ordinary Annuity Calculator

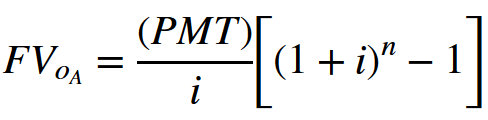

Future Value of Ordinary Annuity Formula

Where:

PMT = Payment

i = Interest Rate

n = Number of times interest compounds times number of periods

What is FV or Ordinary Annuity?

Future of Value of Ordinary Annuity is a finance calculation used to determine the future value of an investment if an investor makes regular payments at the end of each period in a series, taking into consideration the interest rate. This formula makes the assumption that the investment maintains a fixed interest rate for the period(s) being evaluated. This is a tool to evaluate investment alternatives, for example where interest on an investment is calculated monthly vs annually.

Future Value of Ordinary Annuity Example

The finance manager at Shoeburger Corp would like to evaluate an investment of $80,000 for a long-term five year product. The interest rate is fixed at 6% and it will be compounded annually. She would like to know what the value of this investment will be at the end of the five years. It is calculated as follow:

FVOA = ($80,000/.06)*[(1+.06)5-1]

FVOA = $450,967.44

The finance manager has an alternative to the above investment but the interest compounds monthly at 6% with monthly payments of $5,000 at the end of each month (again covering a five year period). The finance manager would like to see what the difference is between the two investment choices. As follows:

The first step is to calculate i based on monthly compounding:

i = .06/12 = .005

The second step is to determine n. Since interest is compounding monthly and we are looking at a 5 year period, then n = 12 * 5 = 60.

Given step one and step two, the Future Value of Ordinary Annuity formula looks like the following:

FVOA = ($5,000/.005)*[(1+.005)60-1]

FVOA = $348,850.15