Present Value of Annuity Due Calculator

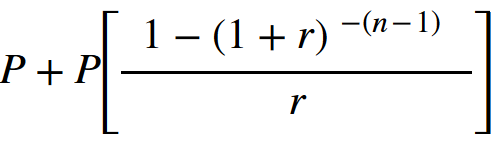

Present Value of Annuity Due Formula

P = Individual Payment in each period

r = the interest rate

n = the number of periods

What is PV of Annuity Due?

The present value of annuity due (also known asa an immediate annuity), is a financial formula that calculates periodic payments that start immediately. The formula is almost the same as the formula used for an ordinary annuity, but in this case the immediate cash flow is added to the present value of future remaining periodic cash flows. This formula is used to evaluate lump sums payments; should a lump sum be accepted now, or is it beneficial to collect a series of future cash payments.

For example, ShoeBurger Corp would like to evaluate payments made to a key partner over the next 10 years for the rights to use their patented packaging process. ShoeBurger must pay their partner $150,000 per year. How much is the present value of these payments assuming 5% interest? The present value of making these payments over the next 10 years is $1,216,173.25, whereas they will pay their partner $1.5M over the same period. It may be a better investment to offer their partner slightly more than the $1,216,173.25, as ShoeBurger could save close to $300k over the 10 year period.